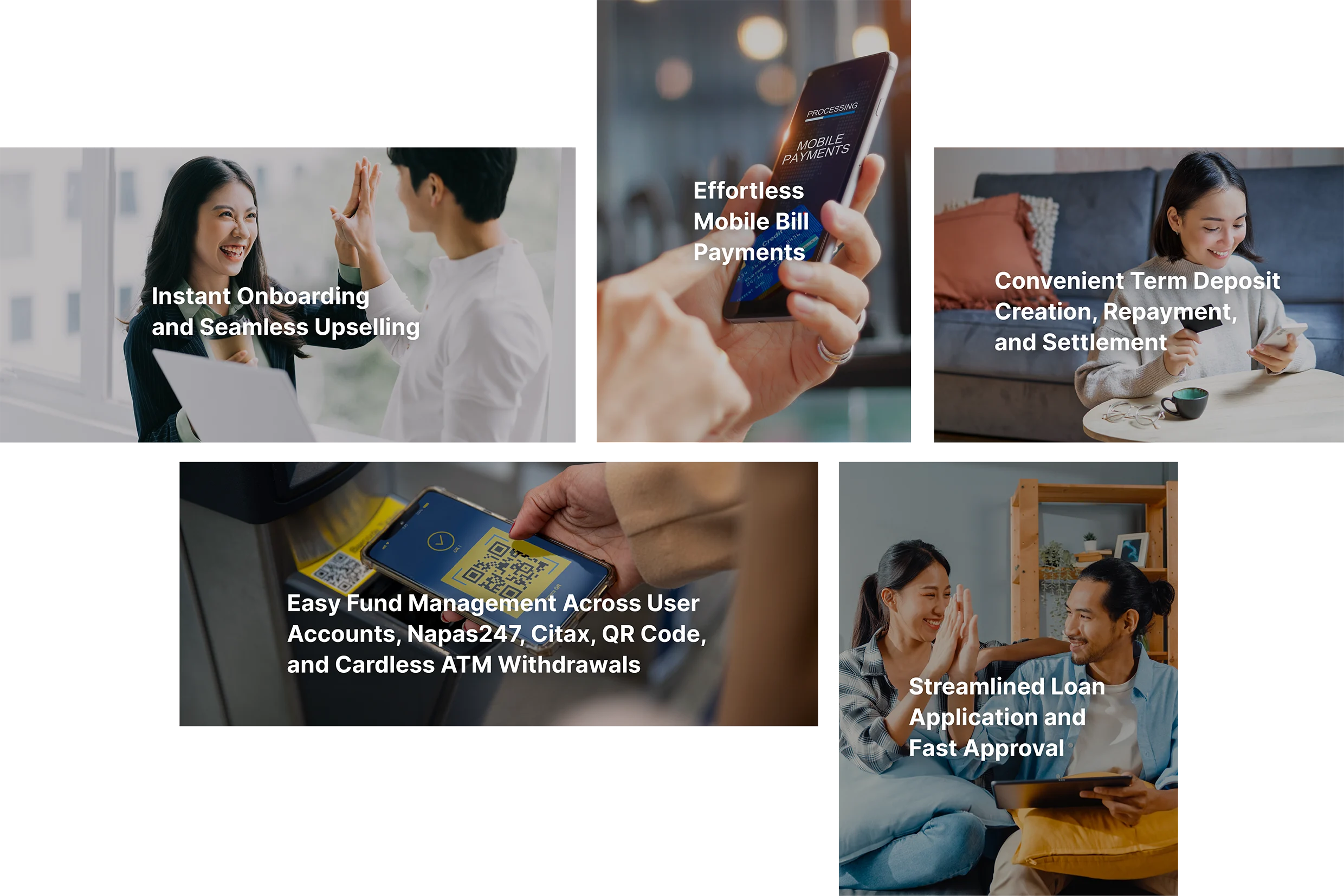

SmartOSC’s Engagement Banking serves all business lines

Our solution is a catalog of pre-built banking modules that can be mixed and matched on-the-fly to build a bank while minimizing implementation risks.

Regardless of your business lines: Retail Banking, Business Banking or Wealth Management, get ready to transform siloed banking channels, reduce market risk, and continuously enhance the customer experience with our pre-built features.